Protecting Your Assets: Trust Foundation Competence within your reaches

In today's complicated financial landscape, ensuring the protection and growth of your assets is vital. Depend on foundations offer as a cornerstone for safeguarding your wide range and heritage, supplying a structured approach to property security.

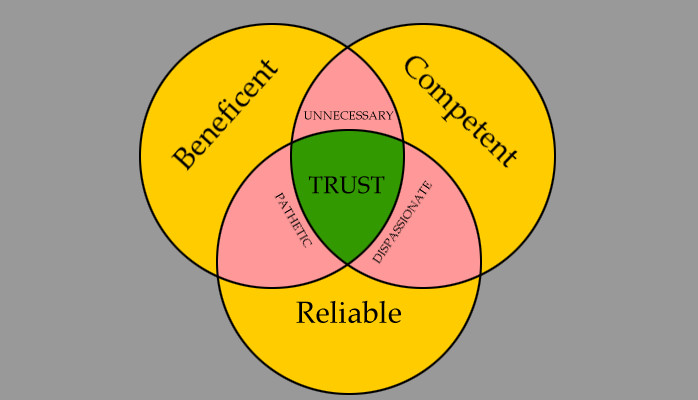

Importance of Trust Fund Structures

Depend on foundations play a vital duty in establishing trustworthiness and promoting solid connections in different expert setups. Trust foundations offer as the keystone for ethical decision-making and transparent communication within organizations.

Benefits of Specialist Support

Building on the foundation of rely on specialist partnerships, looking for professional support supplies vital benefits for people and companies alike. Professional advice offers a wealth of understanding and experience that can help navigate complicated economic, lawful, or calculated obstacles with ease. By leveraging the know-how of specialists in various fields, individuals and organizations can make enlightened choices that line up with their goals and aspirations.

One considerable benefit of expert support is the capability to accessibility specialized knowledge that might not be conveniently offered or else. Specialists can provide insights and point of views that can cause cutting-edge remedies and chances for growth. Furthermore, collaborating with experts can aid mitigate risks and unpredictabilities by providing a clear roadmap for success.

Furthermore, specialist support can conserve time and resources by streamlining processes and preventing costly errors. trust foundations. Experts can use personalized suggestions customized to certain demands, ensuring that every decision is well-informed and critical. Overall, the advantages of specialist guidance are diverse, making it a useful possession in guarding and maximizing properties for the lengthy term

Ensuring Financial Safety

Making certain monetary safety and security involves a complex method that encompasses various facets of riches management. By spreading out investments across various asset courses, such as stocks, bonds, genuine estate, and products, the risk of significant monetary loss can be important site minimized.

Furthermore, maintaining an emergency fund is important to protect against unexpected costs or income disruptions. Specialists suggest setting aside three to six months' well worth of living expenditures in a fluid, quickly available account. This fund works as a monetary safeguard, offering satisfaction throughout turbulent times.

On a regular basis reviewing and adjusting financial plans in action to transforming circumstances is also critical. Life occasions, market changes, and legal modifications can affect economic stability, highlighting the relevance of continuous evaluation and adjustment in the search of long-term economic security - trust foundations. By implementing these approaches attentively and constantly, people can strengthen their economic footing and job in the direction of an extra secure future

Safeguarding Your Properties Efficiently

With a solid foundation in location for financial security via diversification and emergency situation fund maintenance, the next crucial action is guarding your properties properly. One effective method is property allotment, websites which includes spreading your investments across numerous possession classes to minimize danger.

Furthermore, establishing a trust fund can provide a protected means to safeguard your properties for future generations. Counts on can aid you manage how your assets are distributed, minimize inheritance tax, and secure your wealth from creditors. By applying these methods and looking for professional advice, you can safeguard your possessions properly and protect your monetary future.

Long-Term Property Protection

Long-lasting asset protection includes carrying out actions to secure your possessions from different threats such as economic slumps, lawsuits, or unforeseen life occasions. One vital element of lasting property protection is establishing a trust fund, which can provide significant benefits in securing your assets from official site creditors and lawful disagreements.

Moreover, diversifying your investment portfolio is one more key approach for lasting possession security. By spreading your financial investments throughout different property courses, industries, and geographical regions, you can decrease the influence of market changes on your general wealth. Additionally, frequently evaluating and updating your estate plan is important to guarantee that your possessions are secured according to your wishes in the future. By taking an aggressive technique to long-term asset protection, you can safeguard your wealth and offer financial safety on your own and future generations.

Verdict

In conclusion, count on foundations play an important role in protecting assets and making certain financial safety and security. Expert advice in developing and handling trust fund frameworks is essential for lasting asset security.